Business

Tips for Investing for Your First Time

Investing comes down to your money, your time, and your risk. When you make an investment, you have to decide which factor means the most to you. When you add more money to an investment, that means more of your time is being spent (time is money). When you’re investing for the first time, you also have to decide what kind of risks you want to take. Here are some tips for investing for your first time.

Time for Investment

To be able to invest correctly, you really need to know what you will get out of the investments you’re making. Obviously, long term investments are going to yield you a higher return than something you only invest in for 1 or 2 years.

You may consider investing for your retirement, but you may also consider investing for your children’s education fund. There are lots of reasons people “invest.” However, now is a good time to consider all the aspects of investing and what you need to save for in the future.

No one wants to get to the end of their working years and realize they don’t have anything saved for retirement. No one wants their kids to reach adulthood and realize they have nothing saved for their kids’ college education.

Know Your Investment Boundaries

It’s safe to say that investing isn’t something that’s simple. When it comes to investing, you really need to know your investment boundaries. Those boundaries include: growth, income, and safety.

You need to have an emergency fund put in place before you can start investing. What good would it be to invest with your money if you don’t have anything put back to help your current financial situation?

Have an emergency fund of at least 3-6 months put back. This will help you actually be able to focus on your investments and not worrying about something bad happening.

Also, keep in mind that no investment is perfect. You have to know what you feel most comfortable with. Do you want to take more risks? Or do you do you want to play it safe? Always know your investment boundaries before you jump in.

Try a Little Diversification

When you’re investing for the first time, there is a lot to think about. One of the aspects of investing that you need to consider is trying a little diversification. You don’t want to put all your investment into one pocket. Try spreading things out and trying different investment opportunities.

Here are some ways you can diversify your investments

- 401Ks

- Bonds

- Stocks

- Annuities

- Even life insurance can be considered a type of future investment

Know How to Get the Investment You Want

Most things in life, you do yourself. Right? When it comes to fixing the hole in the wall or changing the brakes on your car, you can do those things yourself. When you need to get the investment you want, there are some other factors involved. The biggest factor being experience. If you don’t know much about investing, it could come back to haunt you later in life.

You should decide now if you want to do the investing or if you want to hire someone else to do the investing. There are three options. 1) Invest yourself 2) Have someone help you 3) Pay someone else to invest for you.

Seeking professional help with investing isn’t such a bad thing. This may be the ONE area that you pay someone to help you with. Do you want to know why? The return investment could be worth every single penny! For professional insights and advice on investing, you may consider subscribing to a trusted stock research platform like Kailash Concepts (KCR). KCR specializes on quantamental research and provides investors with credible resources to help identify overvalued and undervalued stocks.

As you can see, all 3 can be a really big risk. Which is why it will take you some time and effort to decide which option is best for you!

Different Types of Retirement Accounts

It’s safe to say that there are a lot of options when it comes to retirement accounts. In fact, there are so many, you may not even know which way to turn. Here is a quick rundown of some of the retirement options available.

- SEP IRA – This retirement account is for those who are self-employed.

- Rollover IRA – When you need to transfer over an existing 401K after you have left the job, consider a Rollover IRA. Of course, you’ll need to pay attention to what you’re allowed to do through your employer.

- You can also look at a Traditional IRA or a ROTH IRA.

As you can see, it’s hard to look at one resource and understand everything you need to know about investing. Read up on investing as much as you can. Listen to podcasts, read books, and ask questions. Are you looking to learn how to invest? Check out How to Start Investing: A Basic Guide for Beginners to learn more about investing and get you on your way!

Business

Celebrate children’s birthdays at Kids Clubs: A smart choice for parents and fun for kids

When it comes to celebrating a child’s birthday, the search for the perfect party can be both exciting and daunting for parents. Kids clubs, such as Little Pandas, offer an attractive solution to celebrate a kids birthday in Geneva, Switzerland. These venues are not just about fun and games; they provide a structured, safe and memorable way to celebrate these special milestones.

Stress free planning and execution

One of the main benefits of hosting a birthday party at a kids’ club is the convenience it offers. Organising a party at home can be overwhelming, with so many details to manage, from decorations to entertainment and clean-up. Kids clubs such as Little Pandas take care of these aspects and offer a hassle-free experience for parents. With professional staff taking care of everything from set up to clean up, parents can focus on enjoying the party with their child.

Safe and well-equipped environment

Safety is a top priority for any parent when planning a party. Kids Clubs are designed with child safety in mind, with child-friendly facilities and staff trained to supervise young guests. This peace of mind allows both parents and children to relax and enjoy the party.

Tailored themes and activities

Kids’ clubs often offer a range of themed parties tailored to a child’s interests, whether it’s superheroes, princesses or animals. This personalisation makes the birthday child feel special and ensures that the party is interesting for everyone. Clubs such as Little Pandas in Geneva are known for their personalised approach, offering different themes and activities to spark children’s imaginations and cater to their preferences.

Developmentally appropriate fun

Unlike generic party venues, kids’ clubs specialise in age-appropriate entertainment. They offer activities that are not only fun, but also contribute to children’s developmental milestones. From interactive games that develop motor skills to creative crafts that stimulate the imagination, these activities are designed to be both enjoyable and beneficial to young minds.

Social interaction and new friendships

A birthday party at a kids’ club is an excellent opportunity for children to socialise and make new friends. In a safe and structured environment, children can interact with peers outside of their usual social circle, building their social skills and confidence.

Memorable experiences

Kids Clubs know how to create memorable experiences. With their expertise in children’s entertainment and party planning, they can turn a birthday party into an unforgettable event. The combination of themed decorations, engaging activities and the joy of being together with friends creates lasting memories for the birthday child and their guests.

Comfort for guests

It is often more convenient for guests to attend a party at a kids’ club. These clubs are usually equipped with facilities and play areas that keep children occupied throughout the event, making it a more enjoyable experience for both children and their parents.

Reduce clutter at home

Hosting a party at home often means dealing with the aftermath – cleaning up, rearranging furniture and disposing of waste. By choosing a kids club like Little Pandas, these post-party hassles are eliminated, allowing the family to relax after the excitement of the day.

Support local businesses

Choosing a local kids club for a birthday party also supports the community. Establishments such as Little Pandas in Geneva contribute to the local economy and often employ local people, making it a choice that benefits more than just the party-goers.

A focus on enjoyment

After all, the most important aspect of a birthday party is fun. Kids Clubs are dedicated to creating an environment that is fun, engaging and joyful. This focus on enjoyment ensures that every child leaves with a smile on their face, making the party a success.

In conclusion, there are many benefits to celebrating a child’s birthday at a Kids Club. From stress-free planning to a safe and fun environment, these venues provide the ideal setting for an unforgettable celebration. Kids clubs such as Little Pandas in Geneva exemplify the benefits of such venues, ensuring that every birthday is a special and joyful occasion – it’s a perfect place to celebrate your kids birthday in Geneva.

Business

Exploring the Best Limestone Commercial Real Estate in Houston

Commercial Real Estate in Houston, Texas’s huge city, is a dynamic market that adapts to the demands of businesses of all sizes. Limestone commercial real estate stands out as a unique and popular alternative among the various possibilities available to business owners and financiers. For the benefit of individuals looking to buy, sell, or lease commercial real estate in the Houston, Texas area, this book will dig deeply into the world of limestone commercial real estate.

Understanding the Appeal of Limestone Commercial Real Estate

· The Beauty of Limestone Architecture

Magnificent structures dot the Houston skyline, and their use of limestone in construction contributes greatly to the city’s aesthetic appeal. Because of its durability, versatility, and classic good looks, limestone is frequently used in the construction of business buildings.

· Superior Insulation and Energy Efficiency

The exceptional insulating characteristics of limestone buildings allow companies to cut costs and environmental impact. This is especially helpful during the sweltering summer months in Houston.

Top Limestone Commercial Real Estate Properties in Houston

· The Galleria Tower

This limestone-clad skyscraper in Houston’s posh Galleria neighborhood has elegant office spaces with panoramic vistas of the city. Business owners like its accessibility to upscale shopping and eating options.

· Memorial Hermann Tower

This limestone masterpiece is located right next to the Texas Medical Centre and has cutting-edge medical office space. Its prime location and beautiful architecture make it a highly sought after resource among medical staff.

· Downtown Houston Plaza

The Downtown Houston Plaza is an iconic building known for its kbeautiful limestone exterior. It’s a thriving commercial ecosystem thanks to its variety of shops, restaurants, and offices.

Leasing vs. Owning Limestone Commercial Real Estate

· Leasing: Flexibility and Cost-Efficiency

Limestone office space for rent in Houston gives companies more options. It’s a great option for new businesses and those on a tight budget that nevertheless want access to first-rate amenities.

· Owning: Long-Term Investment

Commercial properties built with limestone are popular among investors because of its durability and potential for appreciation over time. Investing in these items is prudent because of their propensity to increase in value over time.

Finding the Perfect Limestone Commercial Real Estate

· Location, Location, Location

Houston is huge, so finding the ideal spot is essential. Think about things like where your customers and suppliers are located in relation to you.

· Budget Considerations

Think about your financial goals and determine a reasonable spending limit. There is a wide range in pricing for limestone homes, so it is important to shop around.

· Amenities and Features

Compare the services and facilities provided by various lodgings. Find locations that offer the amenities and services essential to the success of your company.

Navigating the Limestone Commercial Real Estate Market

· Collaborate with a Local Realtor

It’s highly recommended that you use a business real estate agent with experience in your area. They know the market through and out and can guide you to the ideal home.

· Due Diligence

Perform exhaustive due diligence before committing to any contracts. This entails looking things over, checking them out legally, and learning the ins and outs of the lease or purchase agreement.

· The Future of Limestone Commercial Real Estate in Houston

Houston’s commercial real estate built on limestone will continue to stand out in the city’s surroundings. It will always be popular thanks to its classic good looks, low energy consumption, and adaptability.

Conclusion

Limestone commercial real estate in Houston, Texas, is a one-of-a-kind opportunity for companies and investors. It’s a strong contender in a crowded market thanks to its appealing design, low energy consumption, and convenient placement. Whether you’re just starting out in business or you’re a seasoned investor, learning more about Houston’s limestone commercial real estate might lead to some very promising opportunities.

FAQ’s

1. What are the benefits of choosing limestone commercial real estate in Houston?

- Houston’s limestone commercial real estate is a popular option because of its attractiveness, energy efficiency, and soundproofing.

2. How can I find the best limestone commercial real estate property in Houston?

- Location, price, and features should all be taken into account while searching for a business property made of limestone. It might be quite helpful to work with a real estate agent in your area.

3. Is owning limestone commercial real estate a good investment in Houston?

- In the long run, commercial properties built with limestone in Houston might be a good investment.

4. What should I look for in a lease agreement for limestone commercial real estate?

- Check the lease details, including rent, lease period, and any additional charges, before committing to a business lease on limestone property.

5. How does limestone architecture contribute to Houston’s skyline?

- The eternal beauty of Houston’s skyline is largely due to the widespread use of limestone in construction.

Business

Unleashing the Power of Amazon’s GPT55X: A Revolutionary Language Model

Amazon’s GPT55x is a game-changing development in the field of AI, which is constantly developing and diversifying. This language model’s incredible flexibility and power have made it very popular across the globe. In this essay, we will investigate GPT-55X from every angle possible, covering its history, capabilities, and potential uses. Come along as we explore the depths of this intriguing AI technology.

The Genesis of Amazon’s GPT55x

Amazon’s GPT55x, which stands for “Generative Pre-trained Transformer 55X,” was developed by Amazon Web Services (AWS), a frontrunner in the market for cloud computing and artificial intelligence technologies. The original goal of this project was to advance the state of the art in natural language processing (NLP). AWS spent a lot of time and energy improving upon previous versions of their language model.

The Technical Marvel Behind GPT55x

Examining the technology behind GPT55x is crucial for grasping its capabilities. One of the largest and most advanced AI models yet built, this language model is driven by a huge neural network with 55 trillion parameters. Because of its massive size, GPT55x can understand and produce text with unrivalled precision and coherence.

Unraveling GPT55x Capabilities

Natural Language Understanding

Amazon’s GPT55x superior ability to interpret natural language is one of its most impressive qualities. It understands nuanced linguistic features including context, mood, and tone in human speech. This quality makes it useful in many contexts, such as chatbots and content creation.

Multilingual Proficiency

Amazon’s GPT55x is fluent in a wide variety of tongues. The ability to communicate effectively across language boundaries is made possible by its proficiency in many languages. The possibilities for growth in the business world are unprecedented.

Content Generation

Authors, your time has come! Amazon’s GPT55x can produce excellent, contextually appropriate writing on a wide range of themes. This AI model can generate content such as blog entries, product descriptions, and social media updates, saving content marketers valuable time and energy.

Applications Across Industries

E-Commerce Revolution

Amazon’s GPT55x is revolutionary in the realm of online business. It can sift through customer feedback, provide product suggestions, and even tailor the shopping experience to the individual. The result is more revenue and happier customers.

Healthcare Advancements

The ability of GPT55x to grasp natural language is very useful in the medical field. It can help doctors make more precise diagnoses, transcribe medical data, and provide patients more up-to-date information.

Financial Insights

Because of its speed and accuracy in analysing financial data, financial organisations rely on GPT55x. It helps with things like weighing risks, finding signs of fraud, and analysing potential returns on investments.

The Future of Amazon’s GPT55x

Amazon’s GPT55x is poised to become increasingly important across sectors as AI develops. It can be easily modified and expanded, making it applicable for a long time to come thanks to its future-proof nature.

Conclusion

Amazon’s GPT55X is a groundbreaking innovation in artificial intelligence. Its wide-ranging capabilities, which include everything from natural language processing to content development, have upended a wide variety of fields. We may expect GPT55x’s influence to grow in the years ahead, which bodes well for further exciting developments.

FAQ’s

Is Amazon’s GPT55x available for public use?

Yes, Amazon’s GPT55x is available through Amazon Web Services and ready for use in software.

How does Amazon’s GPT55x compare to earlier versions of GPT?

The size, precision, and multilingual capabilities of GPT55x are all improvements over its predecessors.

Is GPT55x suitable for small businesses?

GPT55x does, in fact, provide price options that small and medium-sized enterprises may afford.

What are the potential ethical concerns surrounding GPT55x?

As with any AI system, GPT55x raises ethical problems concerning discrimination and misuse.

-

Marketing1 year ago

Marketing1 year agoHow Often Should You Publish on a Blog?

-

Technology1 year ago

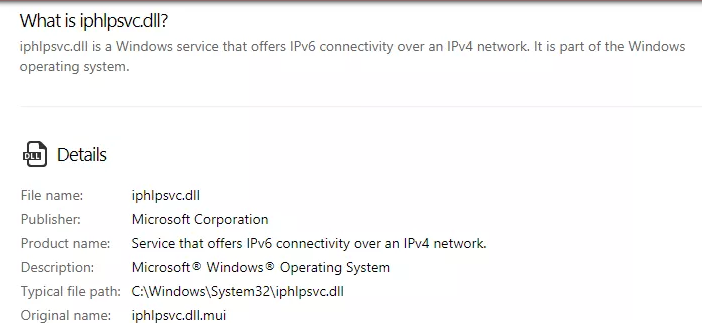

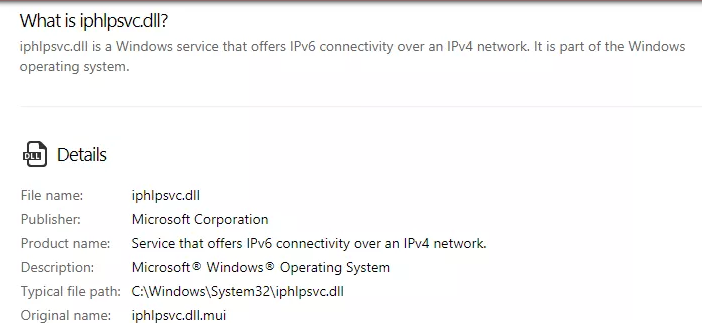

Technology1 year agoIPHLPSVC Services Tuning? Windows 7/10

-

Technology1 year ago

Technology1 year agoHow AI Can Transform Healthcare

-

REVIEWS1 year ago

REVIEWS1 year agoBest Gaming Communities Like F95zone

-

OUTDOOR1 year ago

OUTDOOR1 year agoColoring Black and White Photo at Home

-

Technology1 year ago

Technology1 year ago5 Best React JS UI Frameworks for Swift Prototyping

-

GAMING1 year ago

GAMING1 year agoPick N Mix: A Slots Adventure for Everyone

-

REVIEWS1 year ago

REVIEWS1 year agoAll You Need to Know About KissAnime – Is it Safe and Legal?