Finance

A Guide to Personal Finances and How to Make the Most of Your Income

What comes to mind when you think about finance or managing your finances? Is it stress, pressure and hassle? In reality, managing your expenses and making the most out of your income is not all that difficult.

Having a financially secured life is considered to be a task that only professionals can handle. It is their expertise which you think can help you sail the boat. But before seeking professional help. It is imperative to understand who you are, what you want to get and where you stand in your finances.

According to a 2019 survey, 9 out of 10 adults felt happy and satisfied when their finances were in order. These few steps can be your guide for further satisfaction.

You need to understand that nobody better than you can understand your finances. But first, take a breath. Relax. Saving your funds can seem a little daunting, but here are seven actionable tips to help you start managing your finances without much hassle.

1. Keep in Check Your Credit Report

One of the most important things is to make sure that your Equifax credit report is in place. It contains the summary of how you have handled the credit accounts and the payment history. It will make it easier for the potential lenders and creditors to use this report to decide whether to lend you credit.

Checking this report is to ensure that authentic information exists which is quite vital. It will also help you to keep track of all the credit and expenses that you have incurred making it easier to handle.

2. The 50/30/20 Budget Rule

Creating a budget will give you clarity. When you decide to manage your money, most efficiently and to keep your current cash flow in check using this rule plays a vital role. It is a simple and sustainable way to carry out things. Ensure to divide the finances in proportions that can fulfil your needs, wants and makes you save.

Ensure that 50% of your finance is used to make payments that you won’t avoid. Essentials like rent and electricity bill. 30% of which are for your wants. Wants include non-essential expenses or the “nice to haves” without which you can live. Stash the rest 20% for your savings. Set aside that 20% to help build a smart saving plan.

3. Borrow Smart

When you want to enhance your assets or even make big-ticket purchases will involve taking out loans, but in terms of financial security, it is essential to note that you only borrow what you truly need. Your conscience must tell you how much you are liable to borrow so that you can meet your other goals.

In case you want to borrow for your business concerning it to grow. You can always opt for options that you consider to be secure as the government small business loan. Also, if you are looking to buy a car, house or education, you need to ensure that your borrowing will not affect your future endeavours.

4. Pay Off Your Debt

The next step to build financial security is to pay off all the money that you owe. It can be a financially strategic move concerning safeguarding the funds that you have. When you think from a financial point of view, the ‘avalanche’ method could make more sense. Focus on paying debt with a higher interest rate will reduce the burden of financing more money overall.

You can also choose the ‘snowball’ method where you focus on clearing the smaller debts first. Although; the overall amount might be a little more. Your motivation and sense of achievement can encourage you to pay the debts off faster.

5. Setup Your Emergency Fund

If the sub-heading rings a bell in your head as to what it is, then take a step to execute it. To secure your finances, you need to save for an emergency. It is set aside in case of any emergency like medical, loss of a job or catastrophe.

This fund will help you get back on your feet as early as possible. This will restrict you from borrowing money and burdening you to pay along with interest. To save, you can always set aside the amount at your home or even your savings account to ensure safety. Save money in a way that can cover enough of your three months of living expenses.

6. Save for Your Retirement

It might sound a dream far to conquer, but it still holds an important place in managing your personal finance. It is never too late but involves perfect planning. You need to enlist your retirement goals and also determine the period that you have to meet them.

You can always save through putting into special retirement accounts and always look for account’s, that can help with the tax benefit. Retirement plans do evolve over the years, so what is crucial is to stay updated.

7. Keep a Track

If you consider one task that is tedious in managing the income is keeping a track. It is contemplated to be easy, but it isn’t. You can always rely on budgeting apps to make the task simpler. They tend to bring all your finances under a simple dashboard.

Along with it, you can also set up financial calendars and include reminders of essential financial tasks like paying quarterly taxes or checking Equifax credit report. It takes down the burden and saves you from hassle down the road.

Conclusion

Managing your personal finance is a way to secure your future with all the amenities you wish. It is never too late to take action.

With a little bit of effort and some conscious spending, you can save up a lot at the end of each month. The seven tips mentioned in this article will help you get your boat sailing. Come with some of your own methods as well!

Which of the abovementioned tips do you think are most relevant to you?

Finance

How to Manage Your Finances Effectively

In life, there is a range of big decisions and important events that require high levels of planning and forethought—from organizing the trip of a lifetime to an exotic destination, to arranging the many steps that are required when planning a wedding.

Big moments in life often require the need for effective financial planning in order to make them a reality. In 2023, the financial climate for many people is extremely challenging with inflation levels rising across the world and wages being stretched further than ever before. Therefore, it is of paramount importance that all adults learn and practice some prudent financial management strategies so that they can remain in control of family budgets and minimize non-essential outgoings.

In this article, the importance of sound financial management skills will be explored in detail. Two key strategies or situations will be discussed that illustrate the importance of intelligently managing your personal finances.

Learn to save

One of the most important aspects of sound financial management is to learn the skill of saving money. In today’s consumer culture, many people find that it can be all too easy to rely on forms of personal credit to buy larger purchases. It is estimated that approximately 191 million Americans use a credit card on a regular basis, which can be a useful form of currency when short-term finances are low. However, an overreliance on credit cards and other forms of personal finance can lead to an inability to save money for the future. Put simply, when credit card bills need to be paid each month, the fees and charges can negate the ability to save.

Saving money each month is incredibly important to allow you to plan for unexpected events that require short-term cash or to plan for future activities that require a significant financial outlay. Even if you can only afford to save a small proportion of your wages each month, getting into a regular habit of saving can be instrumental in allowing you to reach your longer-term financial goals.

Find the best mortgage deal for you

Getting on the property ladder is a key achievement in most young adults’ lives. Today, it is harder than ever to secure a mortgage as house prices have risen in recent years. Rises in inflation have not been matched by similar increases in earnings for millions of workers, which has impacted on many people’s ability to save for a deposit on their first home. Therefore, it is more important than ever to speak to a team of mortgage professionals when considering buying your first home. If you live in the midwestern states of America it may be beneficial to search for mortgage lenders in Ohio. Be sure to compare the offerings of a range of mortgage providers to determine the right finance options for you, and remember to save years ahead of when you plan to purchase so you can afford as large a deposit as possible. This will allow you to enjoy lower monthly repayments and therefore have a higher level of funds that can be saved for the future.

In conclusion

Learning to save money each month is one of the most important facets of smart personal financial management. By reducing your reliance on common forms of consumer credit you will be able to plan your finances more effectively and reduce your outgoings each month. Sound financial management is imperative when it comes to securing your first mortgage and it is important to budget realistically whilst also taking advice from mortgage professionals.

Finance

How Protein Supplements Help Build Muscle

Frequently consumed by active adults for recreation purposes as well as athletes who are looking to improve physical performance, protein supplements help in the achievement of strength and muscle mass.

Muscle-Building Using Protein

The role of protein in the body cannot be understated. As it builds and maintains all types of body tissue, then it is an intricate part of our diets. Protein contains amino acids, which serve as building blocks for muscle growth.

This is why the use of protein supplements expedites the growth of muscles. Research states that the more you take your protein supplement, the higher the level of amino acid that is absorbed into your bloodstream, which ultimately triggers a significant response for muscle synthesis.

Depending on your preference, you may choose to take these supplements during or after training so as to enhance your performance and improve recovery. Equally, you can opt to add the supplement to your daily meal or even drink protein shakes between meals.

The Muscle-Building Process

In order to give you optimum results where muscle-building is concerned, protein supplements work in the following ways:

Whenever you exercise, there are tiny muscle fibers that inevitably tear. The amino acids that are found in protein supplements are meant to not only repair the torn muscles but also make the muscle grow bigger and stronger.

The constant repair process is how supplements build muscle. The only difference is that the supplements you consume repair muscles more rapidly than an ordinary protein diet would, thus the quick growth of muscles.

If you are on a protein-deficient diet, then you will find it very hard to build your muscles. Granted, you will experience a little bit of muscle growth but not as much as you would on a high-quality protein diet.

Remember, protein on its own does not build muscle, it is through repairing muscles that are torn by exercise that protein helps in the growth of muscles.

Supplement consumption is the quickest way to get protein into your diet. Even so, you need to remember that these supplements need to be paired with a healthy diet to be successful. In order to enjoy greater benefits, you should also exercise regularly.

The Bottom Line

If you are looking to build muscle in the fastest and most convenient way, then protein supplements are your best bet. However, you will enjoy optimum results when you pair your supplement with a nutritious diet and resistance training.

Ideally, this combination is perfect if you are looking to gain muscle quickly and steadily, for a particular reason. It could be for athletic, recreation, or bodybuilding purposes. However, if these are not your end goals then a high-quality diet with a little bit of working out will keep you on a healthy track.For more information on protein supplements, go to https://www.wilsonsupplements.com/

Finance

What Are Crypto Signals – A Simple Guide for Beginner Learners

If you don’t know what crypto signals are, this guide is for you. The trading world is full of intricate algorithms, manual and automated processes, and different traffic channels. There are new and actual crypto signals appearing each day. These are the data developed by expert traders to trade cryptocurrency at a better level. Suppose you want to learn how to trade Bitcoin beneficially. Check these trusted and profitable crypto signal providers – they might become your greatest helpers.

The Best Crypto Signals – Gain Profit and Win More With Telegram Crypto Signals

What are crypto signals Telegram? They are considered to be specific safetrading.today instructions to help individuals buy crypto at the right price and set the stop loss correctly. These could be private analysts, groups of traders, or telegram channels to track the changes in the Coins and Gems.

Why should you follow cryptocurrency signals? They will help you feel sure in the trading market, group your knowledge and get cash in.

When you get better at crypto signals and use them in your trading practice, you may expect a very good outcome. These are some of the most popular and the best crypto signals for beginners:

- Manual and automated signals are the first to learn. Manual signals are designed by a single expert or group of traders based on their professional experience. Automated signals rely on the online bots who track the statistics, mark the changes and monitor the market.

- The best paid crypto signals https://safetrading.today/traders/paid/ and free analogues – means, you don’t need to pay the fees. But you have to deal with a particular broker, make calls or leave messages with a specific expert. In the second case, you should cover the fees for a certain period of use.

- Exit and entry signals fall into the last group from the list. These signals indicate the right time to enter or exit the deals to gain profit.

A good perception of the signals and the ability to track changes on the market are the prerequisites of your trading success. The more insights you get from the safetrading.today signals the more advantages you have when trading online.

Get Crypto Signals Telegram and Win the Trading Game

Is it safe to use trading signals? Whether you are a beginner or an advanced trader, there are so many risks for you in the trading market. Experienced traders know the ins and outs of the industry, while you have to be careful with even the tiniest things.

It is safe to use crypto signals if you find a safe platform with trading clues. Safetrading.today can give you expert support at the beginning of your trading path and get useful insights about the signals.

-

Marketing1 year ago

Marketing1 year agoHow Often Should You Publish on a Blog?

-

Technology1 year ago

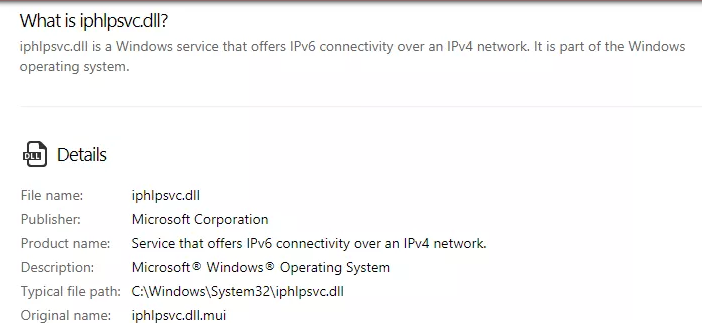

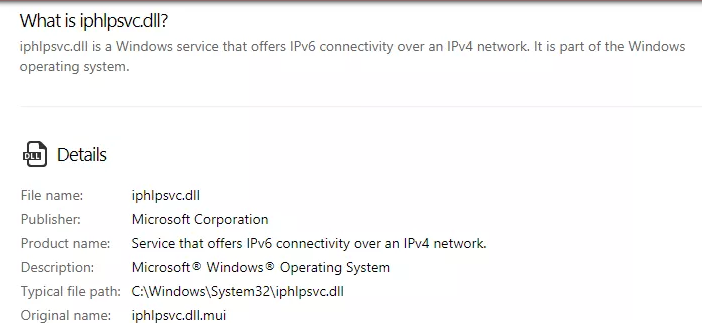

Technology1 year agoIPHLPSVC Services Tuning? Windows 7/10

-

Technology1 year ago

Technology1 year agoHow AI Can Transform Healthcare

-

REVIEWS1 year ago

REVIEWS1 year agoBest Gaming Communities Like F95zone

-

OUTDOOR1 year ago

OUTDOOR1 year agoColoring Black and White Photo at Home

-

Technology1 year ago

Technology1 year ago5 Best React JS UI Frameworks for Swift Prototyping

-

REVIEWS1 year ago

REVIEWS1 year agoAll You Need to Know About KissAnime – Is it Safe and Legal?

-

GAMING1 year ago

GAMING1 year agoPick N Mix: A Slots Adventure for Everyone