Technology

Can Blockchain Change the Forex Industry?

In the world of forex trading, the markets move quickly, with changes by the hour. With things updating all the time, it’s crucial that all trading is tracked and recorded appropriately.

One way that the industry has managed to keep track of the shifting numbers is through blockchain. But what is blockchain? And what does this tech mean for forex? Here is a look at where it fits in and how it can be useful.

What is Blockchain?

Blockchain is a record-keeping network that links bitcoin and other types of cryptocurrency. It’s a public digital database that stores information about this virtual currency and it has the potential to replace traditional exchanges. The ‘blocks’ in the term ‘blockchain’ are the information and the ‘chain’ is the database itself. This database is stored across lots of computers.

The information that’s stored on each block is information about financial transactions, who is making the transactions, and a unique code, which is designed to distinguish it from other blocks. As this is such sensitive information, it can’t be changed without the consensus of a majority of users. This means that the risk of fraud is minimal. However, while this is a secure database, anyone can see the contents of the blockchain.

While its main market is cryptocurrencies, it could prove useful for big names like Apple, which has already stated its interest in blockchain-based digital money.

How is Forex Traded?

As forex trading has been in place as it is for decades, it operates relatively smoothly. This heritage makes it something of a dependable market to trade in. For those looking to get into the world of forex trading, therefore, they can start out with a practice run by opening a demo trading account, where they can practise trading in real market conditions.

Forex itself is trading as it always has, which is through a base filled with a network of traders, bankers, brokers, and stocks and shares experts. It has sessions that open and close at locations across the globe at the same time, making it a market that is always trading throughout the day at some location in the world.

The issue with this is that there’s not a single location where trading can be done, and where it can be regulated. While London is where the forex market is predominantly based, there are other locations, such as The City’s nearest rival, New York.

The fact that it’s decentralised means that there are discrepancies between the different markets and how they’re governed. For instance, the Financial Conduct Authority (FCA) in the UK, or the Commodity Futures Trading Commission (CFTC) in the US have different regulations. Because of this, there can be a lack of transparency as there are different levels of inspection across different forex markets.

How can Forex Benefit from Blockchain?

There are a few ways that forex could benefit from the blockchain. First, the issue of transparency. As blockchain is a public ledger, it’s visible to other users on the platform. This makes it more straightforward than the mixture of forex marketers and brokers.

Also, it has the ability to impact on decentralisation. This is because, by nature, blockchain is a secure, permanent record of financial information. Therefore, it removes record keeping from one hub and opens up availability.

It also could make forex more secure. Due to its digital nature, blockchain has been designed to be incredibly secure. The data stored on the blocks are not as easy hack, meaning that delicate financial details can be stored safely.

However, blockchain has its drawbacks. For instance, while the decentralised nature of blockchain opens up a lot of possibilities, it also means that systems can’t be easily created by forex regulators who want to adopt blockchain. This is because they can’t go in and create a set of rules around this.

Where we go next will depend on how ready the world of forex is to take the leap. It may take time before both are perfectly aligned, but it could be worth it in the long run.

Technology

GoogleMcom: Revolutionizing Online Search

GoogleMcom search engines like Google have become indispensable in the modern day. Search engines are vital tools for navigating the web and finding what you need a new player in the search engine industry, is making waves with its ground-breaking strategies.

The Importance of GoogleMcom

Stands out from the competition because of its focus on the user, which manifests itself in highly customised search results. It takes into account the complexity of user requirements and the rapid pace of current life to help users quickly locate the information they need.

How to Use GoogleMcom

It’s easy to navigate you may use a web browser or the app to get to it. Just type your question into the search box once you get to and its sophisticated algorithms will do the rest.

GoogleMcom Features and Benefits

There are several advantages to using as opposed to other search engines. Among its many remarkable characteristics are:

Personalization:

Over time learns from your search history and preferences to provide you better results.

Voice Search:

The ability to do searches using voice commands is a handy feature.

Search Filter:

Filters allow you to quickly refine your search and discover exactly what you’re searching for.

The Evolution of GoogleMcom

Since its beginning has experienced rapid expansion. Once an innovative concept with game-changing potential, it’s now a robust search engine with constantly evolving algorithms.

GoogleMcom vs. Other Search Engines

When compared to Google, Bing, and Yahoo is far superior in terms of customization and speed. It’s built to learn your preferences and provide up relevant outcomes, which potentially revolutionise the search engine industry.

Tips for Optimizing Your GoogleMcom Experience

Follow these suggestions to get the most out:

Use Specific Keywords:

If you want more precise results from your searches, you should use clear and explicit language.

Explore Filters:

Try out the many search options to find the one that best suits your needs.

Bookmark Your Favorites:

Make rapid access to your favourite sites by saving them.

The Future of GoogleMcom

The road ahead for a long as the technology behind online search continues to evolve, it will become more user-friendly and efficient. Always adapting to new technologies.

GoogleMcom for Businesses

Advantages include the potential for more targeted marketing campaigns and deeper connections with existing customers powerful resource for businesses trying to expand their internet visibility.

Security and Privacy on GoogleMcom

These concerns are taken very seriously by the platform takes the security of your data and online activity very seriously.

Conclusion

Changing the way people search for information on the web poised to become an important player in defining the future of internet search as technology continues to develop.

FAQ’s

FAQ 1: What is GoogleMcom?

Cutting-edge search engine optimised for speed and precision in its results.

FAQ 2: Is GoogleMcom a Replacement for Google.com?

It’s a novel way to conduct web research.

FAQ 3: How Can I Download GoogleMcom?

Available for download from the appropriate website or app store. You may use it on a desktop computer or a mobile phone.

FAQ 4: Can I Customize GoogleMcom?

Yes, you can customize to a certain extent. You can set preferences and filters to tailor your search results to your liking.

FAQ 5: Is GoogleMcom Available on Mobile?

Mobile phone users may access On-the-go, specialised searches are now possible with this programme.

Technology

Exploring wserial: Your Ultimate Entertainment Destination

wserial it comes to the ever-changing landscape of internet streaming is a genuine game-changer. This service’s extensive catalog of shows and movies, along with its seamless interface, has completely transformed the media consumption landscape. This essay will provide a comprehensive look into exploring its history, features, benefits, and competitive advantages.

The Evolution of wserial

Early Beginnings and Development

Began as a simple project with the intention of creating a centralized database for media. Since its origin, it has gone a long way, evolving to meet the needs of today’s viewers.

Impact on the Entertainment Industry

The platform has revolutionized the entertainment business by changing how material is distributed to consumers. It has grown into a streaming industry giant, with significant sway over competing services.

Key Features of wserial

User-Friendly Interface

The straightforwardness and ease of use of interface is a major selling point. Users of all ages will appreciate the platform’s user-friendliness and the simplicity with which they may access their preferred media.

Extensive Library of Content

Large collection of movies and TV shows available to watch online. Everyone may find something they like, from old favorites to very new releases. It’s like heaven on earth for movie and TV buffs.

Availability on Multiple Devices

Used with several gadgets. It’s compatible with mobile devices, tablets, and even smart TVs. This adaptability puts fun within easy grasp whenever you need it.

Subscription Options

Provides flexible subscription options to meet your specific requirements. There’s a plan for everyone, whether you want commercial-free streaming or need to stick to a strict budget.

How to Access wserial

Step-by-Step Guide on Getting Started

Using for the first time is straightforward. To ensure a smooth entry into the community, we will guide you through the necessary processes.

Compatible Devices and Platforms

Find out what hardware and software are compatible so you may enjoy your media anywhere you choose.

Content Categories on wserial

Overview of Available Genres

Action, drama, comedy, and even fantasy may all be found on Wserial. You can always find something new and exciting to do to pass the time.

Popular TV Series and Movies

Learn about some of most well-liked shows and films. You may discover your new favorite show to watch nonstop.

Benefits of Using wserial

Convenience and Flexibility

You can watch your favorite episodes and movies whenever you want with making it more convenient than ever before.

Cost-Effectiveness

Wserial is less expensive than standard cable TV. There are a variety of membership tiers available, so you can choose one that fits your budget.

No Ads and High-Quality Streaming

Put an end to buffering and poor audio/video quality. Guarantees a high-definition, uninterrupted viewing experience.

wserial vs. Competitors

A Comparison with Other Streaming Platforms

We’ll look at wserial in comparison to other popular streaming services so you can see how it stands out.

Unique Selling Points

Learn what makes stand out from the crowd and how you may benefit from using it.

User Experience and Reviews

Testimonials from Satisfied Users

Hear firsthand accounts from happy users about their time using the service.

Ratings and Feedback

Look into what previous customers have said about the service by reading their reviews and ratings.

The Future of wserial

Upcoming Features Improvements

Learn about the exciting new features and anticipated updates coming to the near future.

Expanding the Content Library

Learn about the exciting new features and anticipated updates coming to the near future.

How wserial Aces SEO

SEO Strategies Employed by wserial

Find out how wserial achieves its high search engine rankings and what techniques are used for search engine optimization.

Conclusion

To sum up, wserial is a game-changer in the entertainment industry, not just another streaming service. It’s a must-try for anybody hoping to improve their entertainment experience due to its large collection, user-friendly design, and dedication to high-quality streaming. With you’re in for a ride full of nonstop fun.

FAQ’s

How can I subscribe to wserial?

- Wserial has a simple subscription process. You may pick the best plan for your needs right from the website.

Can I watch wserial on my smartphone?

- Smartphones and other devices are supported by wserial.

Are there regional restrictions on content?

- Due to licensing agreements, certain content may be region-locked, however still provides a vast selection of worldwide content.

Does wserial offer offline viewing?

- If you have a paid membership, you may save videos to watch later.

What sets apart from other streaming platforms?

- Wserial stands out because to its attractive interface, large library, and low membership prices.

Technology

Exploring the World of Slinguri

Slinguri has gained currency and significance in a society where adaptability and power are paramount. These clever implements have matured into dependable options for many different jobs. In this article, we’ll investigate in detail, looking into their origins, varieties, applications, and widespread impact throughout industries.

What Are Slinguri?

Strong straps known as (or “sling-oo-ree”) are often crafted from nylon or polyester. These straps are built to last and can be adjusted to fit any need come in a wide range of lengths and have many different uses because to their special properties.

The History of Slinguri

Slinguri’s roots are intricately entwined with the development of human engineering and ingenuity. Ancient peoples relied on crude slings to carry around huge loads. The contemporary developed from these original slings over time to satisfy the needs of certain industries.

Types of Slinguri

There are several varieties of each one designed for a certain task. Some typical :

- H3: Round Slinguri

- H3: Webbing Slinguri

- H3: Wire Rope Slinguri

- H3: Chain Slinguri

Every kind serves a particular purpose and offers its own set of benefits, hence their use varies widely.

How to Use Slinguri

Knowledge and skill are essential for effective slinguri use. Knowing the proper application is critical for the safety and efficiency of any task involving the fastening of a load, the lifting of heavy equipment, or the towing of a vehicle. We’ll go into the fundamentals of use in a range of contexts.

Slinguri’s Versatility

Amazing because of how many different uses there are for them. Useful to them are:H3: Construction

- H3: Warehousing

- H3: Transportation

- H3: Manufacturing

Slinguri for Outdoor Enthusiasts

Also a must-have for any outdoor lover.Useful items for securing equipment and maintaining safety when camping, trekking, or participating in adventure sports.

Slinguri for Industrial Use

Commonly used to hoist and transport large machines and equipment in industrial situations. They offer a dependable method for safeguarding the security and efficacy of production and building processes.

Slinguri in Everyday Life

Commonly used to hoist and transport large machines and equipment in industrial situations. They offer a dependable method for safeguarding the security and efficacy of production and building processes.

Safety Precautions

Using responsibly is of the utmost importance. We’ll go through some basic safety measures to take when handling these potent instruments so that nobody gets hurt.

Maintenance and Care

Maintenance and upkeep are crucial to the performance and durability Find out what you can do to make sure your lasts as long as possible.

Where to Buy Slinguri

To help you get the most out of your money if you’re looking to buy we’ll give you some pointers on where to get the highest quality.

Slinguri: A Sustainable Choice

Contributing to the increased focus on sustainability.

Pop Culture

Slinguri have left their imprint on mainstream media, including cameos in movies, TV series, and music videos. We’ll look at a few cases where really stole the show in the realm of entertainment.

Conclusion

To sum up are robust and multipurpose instruments that have found their way into many facets of human life. Provide a practical option for a wide variety of uses, from the workplace to outdoor activities and daily chores. They will do you good and help the future if you take the time to learn about them and treat them with respect.

FAQ’s

FAQ 1: Are slinguri only used in industrial settings?

In reality, it’s possible to apply to a wide variety of fields, pastimes, and professions.

FAQ 2: How do I know which type of choose for my specific needs?

Depending on your needs, select when choosing the right kind, you should think about things like load capacity, environmental issues, and safety laws.

FAQ 3: Are slinguri environmentally friendly?

The fact that many are built to last makes them preferable from an environmental standpoint.

FAQ 4: What safety precautions should I take when using?

To avoid injuries, it’s important to always check your before use and to instruct anybody who could use it.

FAQ 5: Where can I purchase high-quality?

Reputed vendors are widely available in both online and offline retail outlets. When making a purchase, be careful to do it from a reliable vendor.

-

Marketing1 year ago

Marketing1 year agoHow Often Should You Publish on a Blog?

-

Technology1 year ago

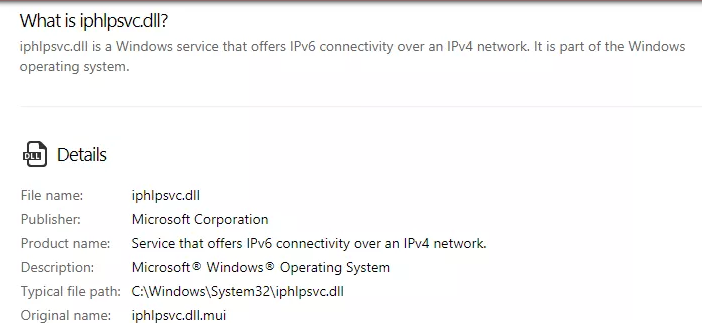

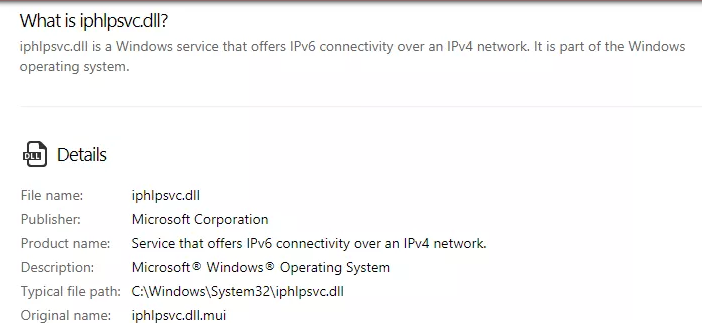

Technology1 year agoIPHLPSVC Services Tuning? Windows 7/10

-

Technology1 year ago

Technology1 year agoHow AI Can Transform Healthcare

-

REVIEWS1 year ago

REVIEWS1 year agoBest Gaming Communities Like F95zone

-

OUTDOOR1 year ago

OUTDOOR1 year agoColoring Black and White Photo at Home

-

Technology1 year ago

Technology1 year ago5 Best React JS UI Frameworks for Swift Prototyping

-

REVIEWS1 year ago

REVIEWS1 year agoAll You Need to Know About KissAnime – Is it Safe and Legal?

-

GAMING1 year ago

GAMING1 year agoPick N Mix: A Slots Adventure for Everyone