ADVISOR

Why Do You Need a Gold IRA Custodian

As we get old, we need to limit the work we do because the body stops being as strong as it used to be. This is why people have to retire at a particular time. But a retired person still needs to take care of themselves and pay some bills which is why retirement saving is very important.

Almost everyone knows this and almost everyone has an IRA account. However, not everyone is fully aware of gold IRAs. Gold IRAs also called precious metals IRAs allow a person to add precious metals such as gold, silver, platinum, and palladium to their Individual Retirement Accounts.

But as you consider this option, you may have heard that you need a custodian. Hence the question “what is a gold ira custodian for?” must have popped up in your mind. If this is the case, then you are in the right place.

In this article, we will be discussing what a gold IRA custodian is and why you need one.

The Role of the Custodian

The term custodian refers to any financial institution which oversees or monitors the assets in the accounts of its clients. This institution typically takes care of financial issues including withdrawals, transactions, and IRS reporting.

To own an IRA, you need a custodian that will monitor the assets in the account. When it comes to precious metals IRAs, the custodian role may slightly differ from that of a conventional account. The reason for this is that this type of account often involves the physical metal. Therefore, a depository where the metal will be stored is often required.

The financial institution will then handle the reporting and paperwork of the assets kept in the depository. Hence, the role of a gold IRA custodian ranges from handling transactions, IRS reporting, and withdrawals. They also are in charge of handling paperwork and tax reporting of the physical precious metal.

A major reason these custodians exist is to ensure that the IRS’s several regulations and rules about accounts that are tax-advantaged are strictly adhered to and respected.

Why Do You Need One?

As we have already stated, IRAs often require a custodian. So, you can’t have an account without having one. The following are some of the important reasons they are required:

They Handle Transactions

Paperwork is very vital when it comes to transactions. The financial institutions involved with this kind of accounts are often very specialized in this aspect. Hence, they are very used to the transactions and paperwork related to the process, this enables them to work swiftly for you.

They Handle the Administrative Needs

Administrative tasks can involve everything from withdrawing the assets (upon your request), distributing the assets, and IRS reporting. Aside from them being used to the paperwork that is required in this case, they often have safeguards that ensure the safety of the transaction details.

They Have and Manage the Proper Relationship with Depositories Where the Metals Are Stored

They ensure the documentation needed in the depository is appropriately filled and that the metals are properly stored.

Which Institutions Can Act as a Custodian?

As we have said, the custodian is often a financial institution such as a bank, trust, as well as other similar institutions. However, before they can act in this capacity, they have to be approved by the IRS. You can visit here https://www.irs.gov/about-irs to learn more about the IRS and what they do.

How Are They Regulated?

Custodians are licensed and approved by IRS. Therefore, they have to adhere to the strict policies and regulations of the IRS. They must fulfill the security laws and capital requirements of the law at both the state and federal governments.

A major factor in determining whether or not a custodian is legitimate and reliable is if they are IRS-approved. You can always rest assured if the custodian is IRS-approved since they are held by the IRS high standards.

Fees to Expect

The fee you would be expected to pay will vary from one custodian to the other. However, generally, you are bound to encounter some fees.

First of all, you will have to pay a one-time fee at the time you open the account. This fee will be used to set up the account, transfer funds, and take care of other transactions. The one-time fee can be between 30 dollars to 50 dollars.

The second fee you would encounter is the management fee. This is often paid annually and it takes care of several costs that are taken care of during a year, from paperwork to annual reporting and so on. As we have said, these fees vary per institution; however, the negotiated rate for this fee is often about 80 dollars per year.

However, this may rise to 100 dollars at the end of the year. This often covers your physical precious metals insurance fees.

Tax Considerations

Having valuable metals in your IRA may be different from having mutual funds, bonds, and stocks in traditional IRAs. Yet, they share certain similarities. With traditional options, you can buy then sell your assets within the account, and then you may pay your taxes during withdrawal or distribution or up.

The same can be said about gold IRAs. You buy the precious metal, hold it in the depository, and then make transactions via a specialist.

In which case, the metals are also like every other class of asset that is held in an individual retirement account. That is, when it comes to tax purposes for your gold IRA assets, you are considered not to have possession of the asset while it is still in the account. You can read this to learn more about how physical gold in several forms is taxed.

Having gold in your individual retirement account is unlike holding the asset outside the account where capital gain tax and other complications will be required.

Conclusion

We believe you now know why custodians are required for gold IRAs and how vital their roles are.

ADVISOR

Aspen sign in Cocke County: A Comprehensive Guide

Aspen sign in Cocke County is a web-based platform designed to provide students, parents, and educators in Cocke County with access to essential educational resources and information. This user-friendly system offers a range of features that facilitate effective communication and streamline various educational processes.

Aspen sign in Cocke County: Empowering Education

Let’s explore its various aspects and understand how it contributes to a more efficient and informed educational ecosystem.

1. Accessing Aspen sign in Cocke County

To access Aspen Login Cocke County, users can visit the official website provided by Cocke County School District. On the homepage, there will be a login section where users can enter their credentials to gain access to the platform. The login process is secure and requires authorized credentials for successful entry.

2. Features of Aspen sign in Cocke County

Aspen Login Cocke County boasts a range of features that cater to the needs of students, parents, teachers, and administrators. Some prominent features include:

- Gradebook: Teachers can use the Gradebook feature to record and manage student grades, assignments, and progress.

- Attendance Tracker: The Attendance Tracker allows teachers and administrators to monitor student attendance and identify any patterns of absenteeism.

- Parent-Teacher Communication: Aspen Login Cocke County facilitates seamless communication between parents and teachers, allowing them to discuss student performance and address concerns.

- Course Registration: Students can use the platform to enroll in courses and select their preferences based on availability.

- Assessment Data: Aspen Login Cocke County provides access to various assessment data, helping educators make data-driven decisions to enhance teaching strategies.

3. Benefits of Aspen Login Cocke County

The adoption of Aspen Login Cocke County yields several benefits for the Cocke County educational community:

- Efficient Data Management: The platform centralizes student data, streamlining administrative tasks and reducing paperwork.

- Improved Parent Involvement: Aspen Login Cocke County fosters parent engagement by offering real-time updates on student progress and activities.

- Enhanced Student Performance: With access to assessment data, teachers can identify areas of improvement and tailor their instruction to meet individual student needs.

- Time-Saving for Educators: By automating certain processes, educators can focus more on teaching and guiding students.

- Increased Accountability: Aspen Login Cocke County enhances accountability among students, parents, and educators, contributing to a more proactive approach to education.

Conclusion

Aspen Login Cocke County is a powerful tool that revolutionizes education in Cocke County by providing a comprehensive and user-friendly platform for students, parents, teachers, and administrators. Its features, benefits, and emphasis on communication and data-driven decision-making contribute to an enriched educational experience. By leveraging Aspen Login Cocke County, Cocke County School District reinforces its commitment to empowering students and facilitating academic success.

ADVISOR

EJustice Login: Access Justice Online

It is now easier than ever to get your hands on legal resources thanks to the internet. eJustice is a platform that helps lawyers and anyone seeking justice work together efficiently. This page will discuss eJustice login, including how to access the system, what features are available, and how to maximise its usefulness. A lawyer, law firm, or someone seeking legal counsel may all benefit from using the eJustice login.

Login to eJustice for Access to Legal Services

Legal experts and everyday citizens alike benefit from eJustice login’s simple access to a wealth of legal materials. By signing into the eJustice system, users have access to case management resources and are kept abreast of the newest changes in the law. Let’s go even further into the benefits of eJustice login and the features it offers.

Factors That Make eJustice Stand Apart

Comprehensive Case Management

Legal practitioners may keep track of cases, clients, and deadlines with ease with eJustice login. The platform’s user-friendly features make it easy to manage files, file legal documents, and work together with customers and colleagues. Lawyers may increase output and simplify processes by taking use of eJustice.

The Easiest Way to Do Legal Research

By providing access to a wealth of legal materials, eJustice streamlines the process of doing legal research. Lawyers who sign in have instantaneous access to a plethora of precedents, legislation, and regulations. Users may save time and energy by using the platform’s powerful search features to locate the exact data they need.

Effortless Conversation

Legal counsel and their clients may communicate more efficiently thanks to eJustice login. Lawyers can keep their clients up to date and provide them sound advice thanks to the platform’s encrypted chat capabilities, which protect their privacy. An open line of communication between attorney and client promotes openness and trust in the professional relationship.

Legal Scheduling and Announcements

You’ll always know when your case is scheduled to be heard in court. Legal practitioners may stay on top of impending court dates and deadlines with the help of eJustice’s calendar and alert features. Lawyers may use this function to keep track of their time, get ready for court appearances, and never miss a deadline again.

Instruction in the Law

The eJustice system acknowledges that ongoing education is crucial for success in the law. The site’s many educational offerings include webinars, seminars, and online courses for the legal profession. Via eJustice, lawyers may easily acquire new skills, refresh their understanding of the law, and maintain their CPD requirements.

Frequently Asked Questions

Where Can I find the eJustice Login?

The procedure for logging into eJustice is simple. To get started, just do what I say:

- Launch your web browser of choice and go on over to eJustice.

- To log in, use the login button on the homepage.

- Please log in with your username and password.

- You may enter your eJustice account by clicking the “Login” button.

- If this is your first time using eJustice, you will need to register for an account. When you’ve signed in, you’ll have access to all of eJustice’s features and capabilities.

Can people who are not solicitors create an account with eJustice?

It gives the legal profession access to unique instruments and information.

Is there a regular schedule for updating the information on eJustice sign in?

The website attempts to keep a comprehensive database of laws, legislation, and judicial rulings.

Can I share my eJustice client login with my clients so we may work together?

With eJustice’s login, solicitors and their clients may exchange messages in confidence. This strengthens the attorney-client relationship by guaranteeing privacy and facilitating open lines of communication.

Is there a way to contact eJustice if I have questions?

If you have any questions or run into any technical issues when using the eJustice login, you may contact customer care for help. The platform cares about its customers and works hard to give them with timely and useful service.

Can my eJustice account be linked to my existing legal software?

By linking their eJustice accounts with other applications, lawyers may expedite their operations in areas such as case management, invoicing, and document automation.

Conclusion

In conclusion, the eJustice login is a robust online platform that gives lawyers easy access to many legal materials and improves efficiency. Lawyers and law firms may improve efficiency, keep abreast of new legal developments, and serve clients more effectively by logging into eJustice. eJustice login will provide you access to a wealth of legal resources, so you may join the digital revolution of the legal sector.

-

Marketing1 year ago

Marketing1 year agoHow Often Should You Publish on a Blog?

-

Technology1 year ago

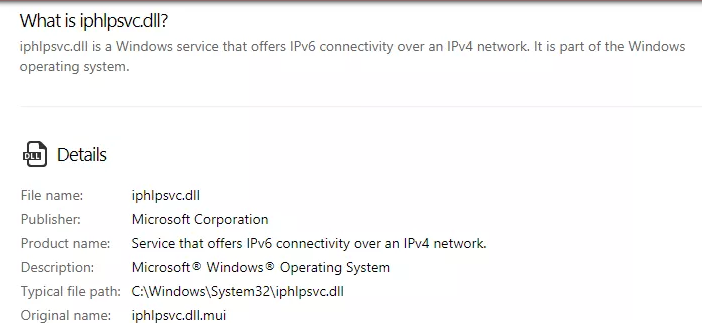

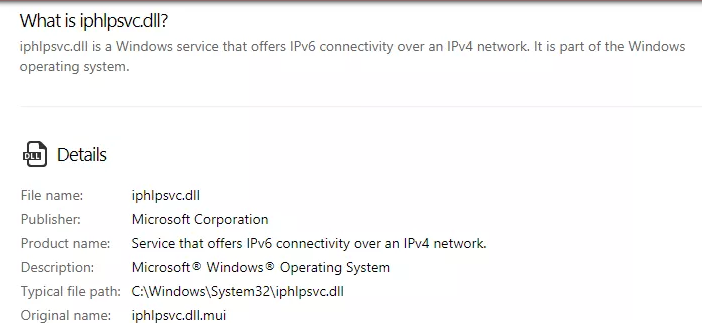

Technology1 year agoIPHLPSVC Services Tuning? Windows 7/10

-

Technology1 year ago

Technology1 year agoHow AI Can Transform Healthcare

-

REVIEWS1 year ago

REVIEWS1 year agoBest Gaming Communities Like F95zone

-

OUTDOOR1 year ago

OUTDOOR1 year agoColoring Black and White Photo at Home

-

Technology1 year ago

Technology1 year ago5 Best React JS UI Frameworks for Swift Prototyping

-

REVIEWS1 year ago

REVIEWS1 year agoAll You Need to Know About KissAnime – Is it Safe and Legal?

-

GAMING1 year ago

GAMING1 year agoPick N Mix: A Slots Adventure for Everyone