Business

Trading Gold – Benefits, Challenges, And Strategies To Add To Your Trading Toolbox

For centuries, households have considered gold as an asset. The women of the household were gifted gold jewelry on special occasions, and this act was creating a safe haven for difficult days.

Today, you can trade in gold in a spread-betting platform just like you would do for forex trading. You need to study the $ pricing of gold and use that to analyze the market movement.

Trading in gold has manifold advantages – but to leverage them, you need to plan well and overcome the challenges. Here, we will throw light on the challenges and benefits and guide you to strategizing your gold trades.

The Benefits Of Gold Trading

We look at the perks of investing in gold to help you strengthen your resolve to invest in it.

Hedging Against Inflation

Investing in the market requires you to be prepared for its volatility and economic turndown situations.

Gold has a strong asset appreciation when you invest in it for longer durations. Since gold shows positive growth even on volatile days, it is one of the best hedging options for you.

Tax Benefits

Depending on your country’s taxation laws, you will find some gold funds where you can trade in gold as a non-equity product.

This enables you to claim long-term capital gain tax benefits, thereby saving a considerable amount of money that would otherwise be gone in taxes.

Better Flexibility

For those keen on portfolio diversification, gold is among the best options available.

In gold trading, you can start small and, over time, build up a good capital. Redeeming gold investments is an easy task as gold investments come with high liquidity.

The Challenges Of Gold Trading

By now, you must be ready to try out alpaca api for gold trading and invest a major part of your capital in this. However, you need to realize that not everything is glittery in gold trading.

To help you get a neutral perspective on this subject, it is important to consider the challenges in gold trading.

Price Dictation By The International Market

The gold prices in most countries are subject to change, depending on the American market.

Thus, investing in gold would require you to keep yourself updated with an in-depth knowledge of the American market, and this may not be feasible for part-time traders.

No Steady Income

Some investors need a regular income from their assets. Investing your money in real estate, stocks, and mutual funds will give you rent and dividends, but you cannot expect the same from your gold.

Planning A Gold Trading Strategy

Irrespective of the reason that is drawing you to the gold trade, you need to have an action plan in place to help you make the most of your investment.

Step 1: Understand What Moves Gold

Being one of the oldest currencies in the world explains gold’s position as a key psyche of the financial world.

Factors like supply and demand, inflation, deflation, greed, and fear are the key polarities that control the price action of gold.

Let us consider a situation wherein a selloff hits the US market. This would cause gold to take off a strong rally.

Someone who does not understand the basic moving factors of gold would simply assume that fear is driving this rally, and they will jump in believing that the price will only go higher.

However, it may be inflation that has facilitated the decline in prices. In such a situation, investing in gold would attract further losses.

To avoid making such mistakes, understand the polarities of gold trading, and make yourself familiar with the rules before trading in the yellow metal.

Step 2: Figure Out The Crowd

Gold investments are a favorite among diverse crowds, and many of them have conflicting interests.

Gold bugs are long term investors who allocate an outsized portion of funds to gold options, futures, and equities and add physical bullion to their collection.

While some gold bugs initiate their gold investments with family assets, others are retail players.

Short sells are another type of gold investor who focuses on scenarios when one of the three primary forces leans in favor of strong buying pressure.

Institutional investors also focus on gold as a part of their bilateral hedging strategies.

Knowing the different types of people who invest in gold will help you understand what you are up against and help you strategize better.

Step 3: Read Long Term Charts

While trading in gold, you cannot expect to have a stock market api that will guide you from day 1.

To do justice to your gold trading, spend some time learning to read the gold chart inside-out and identifying the trends that survived decades.

Evaluate how there was a negligible movement in gold prices till the 1970s and how doing away with the gold standard for $ initiated an uptrend.

Knowing strategic points and price levels wherein metals trickled low for months is important for you to understand the risks involved.

Ideally, you should evaluate the gold charts over multiple time frames and read up on the factors contributing to the patterns you see.

Step 4: Choose Your Risk-Taking Venue

Once you know the basics, the final step is to choose your venue. Realize that liquidity has a direct impact on gold trends.

You can expect it to have a sharp upward or downward spike depending on whether the market moves upwards or is undergoing a quiet phase.

Since futures markets have a much less average participation rate, you can expect such oscillations to have a stronger impact on futures.

Thus, keep your liquidity expectations and the need for easy trade execution in mind while planning your gold trades.

Final Take

In the coming years, the yellow metal is expected to continue acting as a preferred trading option for millions across the globe.

As you venture into the world of gold trading, we hope that the tips in this article were helpful to you.

Business

Celebrate children’s birthdays at Kids Clubs: A smart choice for parents and fun for kids

When it comes to celebrating a child’s birthday, the search for the perfect party can be both exciting and daunting for parents. Kids clubs, such as Little Pandas, offer an attractive solution to celebrate a kids birthday in Geneva, Switzerland. These venues are not just about fun and games; they provide a structured, safe and memorable way to celebrate these special milestones.

Stress free planning and execution

One of the main benefits of hosting a birthday party at a kids’ club is the convenience it offers. Organising a party at home can be overwhelming, with so many details to manage, from decorations to entertainment and clean-up. Kids clubs such as Little Pandas take care of these aspects and offer a hassle-free experience for parents. With professional staff taking care of everything from set up to clean up, parents can focus on enjoying the party with their child.

Safe and well-equipped environment

Safety is a top priority for any parent when planning a party. Kids Clubs are designed with child safety in mind, with child-friendly facilities and staff trained to supervise young guests. This peace of mind allows both parents and children to relax and enjoy the party.

Tailored themes and activities

Kids’ clubs often offer a range of themed parties tailored to a child’s interests, whether it’s superheroes, princesses or animals. This personalisation makes the birthday child feel special and ensures that the party is interesting for everyone. Clubs such as Little Pandas in Geneva are known for their personalised approach, offering different themes and activities to spark children’s imaginations and cater to their preferences.

Developmentally appropriate fun

Unlike generic party venues, kids’ clubs specialise in age-appropriate entertainment. They offer activities that are not only fun, but also contribute to children’s developmental milestones. From interactive games that develop motor skills to creative crafts that stimulate the imagination, these activities are designed to be both enjoyable and beneficial to young minds.

Social interaction and new friendships

A birthday party at a kids’ club is an excellent opportunity for children to socialise and make new friends. In a safe and structured environment, children can interact with peers outside of their usual social circle, building their social skills and confidence.

Memorable experiences

Kids Clubs know how to create memorable experiences. With their expertise in children’s entertainment and party planning, they can turn a birthday party into an unforgettable event. The combination of themed decorations, engaging activities and the joy of being together with friends creates lasting memories for the birthday child and their guests.

Comfort for guests

It is often more convenient for guests to attend a party at a kids’ club. These clubs are usually equipped with facilities and play areas that keep children occupied throughout the event, making it a more enjoyable experience for both children and their parents.

Reduce clutter at home

Hosting a party at home often means dealing with the aftermath – cleaning up, rearranging furniture and disposing of waste. By choosing a kids club like Little Pandas, these post-party hassles are eliminated, allowing the family to relax after the excitement of the day.

Support local businesses

Choosing a local kids club for a birthday party also supports the community. Establishments such as Little Pandas in Geneva contribute to the local economy and often employ local people, making it a choice that benefits more than just the party-goers.

A focus on enjoyment

After all, the most important aspect of a birthday party is fun. Kids Clubs are dedicated to creating an environment that is fun, engaging and joyful. This focus on enjoyment ensures that every child leaves with a smile on their face, making the party a success.

In conclusion, there are many benefits to celebrating a child’s birthday at a Kids Club. From stress-free planning to a safe and fun environment, these venues provide the ideal setting for an unforgettable celebration. Kids clubs such as Little Pandas in Geneva exemplify the benefits of such venues, ensuring that every birthday is a special and joyful occasion – it’s a perfect place to celebrate your kids birthday in Geneva.

Business

Exploring the Best Limestone Commercial Real Estate in Houston

Commercial Real Estate in Houston, Texas’s huge city, is a dynamic market that adapts to the demands of businesses of all sizes. Limestone commercial real estate stands out as a unique and popular alternative among the various possibilities available to business owners and financiers. For the benefit of individuals looking to buy, sell, or lease commercial real estate in the Houston, Texas area, this book will dig deeply into the world of limestone commercial real estate.

Understanding the Appeal of Limestone Commercial Real Estate

· The Beauty of Limestone Architecture

Magnificent structures dot the Houston skyline, and their use of limestone in construction contributes greatly to the city’s aesthetic appeal. Because of its durability, versatility, and classic good looks, limestone is frequently used in the construction of business buildings.

· Superior Insulation and Energy Efficiency

The exceptional insulating characteristics of limestone buildings allow companies to cut costs and environmental impact. This is especially helpful during the sweltering summer months in Houston.

Top Limestone Commercial Real Estate Properties in Houston

· The Galleria Tower

This limestone-clad skyscraper in Houston’s posh Galleria neighborhood has elegant office spaces with panoramic vistas of the city. Business owners like its accessibility to upscale shopping and eating options.

· Memorial Hermann Tower

This limestone masterpiece is located right next to the Texas Medical Centre and has cutting-edge medical office space. Its prime location and beautiful architecture make it a highly sought after resource among medical staff.

· Downtown Houston Plaza

The Downtown Houston Plaza is an iconic building known for its kbeautiful limestone exterior. It’s a thriving commercial ecosystem thanks to its variety of shops, restaurants, and offices.

Leasing vs. Owning Limestone Commercial Real Estate

· Leasing: Flexibility and Cost-Efficiency

Limestone office space for rent in Houston gives companies more options. It’s a great option for new businesses and those on a tight budget that nevertheless want access to first-rate amenities.

· Owning: Long-Term Investment

Commercial properties built with limestone are popular among investors because of its durability and potential for appreciation over time. Investing in these items is prudent because of their propensity to increase in value over time.

Finding the Perfect Limestone Commercial Real Estate

· Location, Location, Location

Houston is huge, so finding the ideal spot is essential. Think about things like where your customers and suppliers are located in relation to you.

· Budget Considerations

Think about your financial goals and determine a reasonable spending limit. There is a wide range in pricing for limestone homes, so it is important to shop around.

· Amenities and Features

Compare the services and facilities provided by various lodgings. Find locations that offer the amenities and services essential to the success of your company.

Navigating the Limestone Commercial Real Estate Market

· Collaborate with a Local Realtor

It’s highly recommended that you use a business real estate agent with experience in your area. They know the market through and out and can guide you to the ideal home.

· Due Diligence

Perform exhaustive due diligence before committing to any contracts. This entails looking things over, checking them out legally, and learning the ins and outs of the lease or purchase agreement.

· The Future of Limestone Commercial Real Estate in Houston

Houston’s commercial real estate built on limestone will continue to stand out in the city’s surroundings. It will always be popular thanks to its classic good looks, low energy consumption, and adaptability.

Conclusion

Limestone commercial real estate in Houston, Texas, is a one-of-a-kind opportunity for companies and investors. It’s a strong contender in a crowded market thanks to its appealing design, low energy consumption, and convenient placement. Whether you’re just starting out in business or you’re a seasoned investor, learning more about Houston’s limestone commercial real estate might lead to some very promising opportunities.

FAQ’s

1. What are the benefits of choosing limestone commercial real estate in Houston?

- Houston’s limestone commercial real estate is a popular option because of its attractiveness, energy efficiency, and soundproofing.

2. How can I find the best limestone commercial real estate property in Houston?

- Location, price, and features should all be taken into account while searching for a business property made of limestone. It might be quite helpful to work with a real estate agent in your area.

3. Is owning limestone commercial real estate a good investment in Houston?

- In the long run, commercial properties built with limestone in Houston might be a good investment.

4. What should I look for in a lease agreement for limestone commercial real estate?

- Check the lease details, including rent, lease period, and any additional charges, before committing to a business lease on limestone property.

5. How does limestone architecture contribute to Houston’s skyline?

- The eternal beauty of Houston’s skyline is largely due to the widespread use of limestone in construction.

Business

Unleashing the Power of Amazon’s GPT55X: A Revolutionary Language Model

Amazon’s GPT55x is a game-changing development in the field of AI, which is constantly developing and diversifying. This language model’s incredible flexibility and power have made it very popular across the globe. In this essay, we will investigate GPT-55X from every angle possible, covering its history, capabilities, and potential uses. Come along as we explore the depths of this intriguing AI technology.

The Genesis of Amazon’s GPT55x

Amazon’s GPT55x, which stands for “Generative Pre-trained Transformer 55X,” was developed by Amazon Web Services (AWS), a frontrunner in the market for cloud computing and artificial intelligence technologies. The original goal of this project was to advance the state of the art in natural language processing (NLP). AWS spent a lot of time and energy improving upon previous versions of their language model.

The Technical Marvel Behind GPT55x

Examining the technology behind GPT55x is crucial for grasping its capabilities. One of the largest and most advanced AI models yet built, this language model is driven by a huge neural network with 55 trillion parameters. Because of its massive size, GPT55x can understand and produce text with unrivalled precision and coherence.

Unraveling GPT55x Capabilities

Natural Language Understanding

Amazon’s GPT55x superior ability to interpret natural language is one of its most impressive qualities. It understands nuanced linguistic features including context, mood, and tone in human speech. This quality makes it useful in many contexts, such as chatbots and content creation.

Multilingual Proficiency

Amazon’s GPT55x is fluent in a wide variety of tongues. The ability to communicate effectively across language boundaries is made possible by its proficiency in many languages. The possibilities for growth in the business world are unprecedented.

Content Generation

Authors, your time has come! Amazon’s GPT55x can produce excellent, contextually appropriate writing on a wide range of themes. This AI model can generate content such as blog entries, product descriptions, and social media updates, saving content marketers valuable time and energy.

Applications Across Industries

E-Commerce Revolution

Amazon’s GPT55x is revolutionary in the realm of online business. It can sift through customer feedback, provide product suggestions, and even tailor the shopping experience to the individual. The result is more revenue and happier customers.

Healthcare Advancements

The ability of GPT55x to grasp natural language is very useful in the medical field. It can help doctors make more precise diagnoses, transcribe medical data, and provide patients more up-to-date information.

Financial Insights

Because of its speed and accuracy in analysing financial data, financial organisations rely on GPT55x. It helps with things like weighing risks, finding signs of fraud, and analysing potential returns on investments.

The Future of Amazon’s GPT55x

Amazon’s GPT55x is poised to become increasingly important across sectors as AI develops. It can be easily modified and expanded, making it applicable for a long time to come thanks to its future-proof nature.

Conclusion

Amazon’s GPT55X is a groundbreaking innovation in artificial intelligence. Its wide-ranging capabilities, which include everything from natural language processing to content development, have upended a wide variety of fields. We may expect GPT55x’s influence to grow in the years ahead, which bodes well for further exciting developments.

FAQ’s

Is Amazon’s GPT55x available for public use?

Yes, Amazon’s GPT55x is available through Amazon Web Services and ready for use in software.

How does Amazon’s GPT55x compare to earlier versions of GPT?

The size, precision, and multilingual capabilities of GPT55x are all improvements over its predecessors.

Is GPT55x suitable for small businesses?

GPT55x does, in fact, provide price options that small and medium-sized enterprises may afford.

What are the potential ethical concerns surrounding GPT55x?

As with any AI system, GPT55x raises ethical problems concerning discrimination and misuse.

-

Marketing1 year ago

Marketing1 year agoHow Often Should You Publish on a Blog?

-

Technology1 year ago

Technology1 year agoHow AI Can Transform Healthcare

-

Technology1 year ago

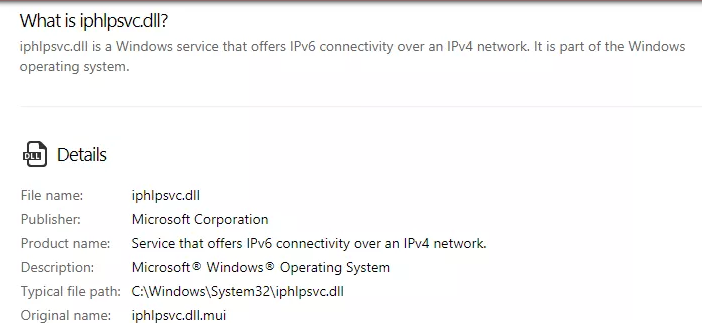

Technology1 year agoIPHLPSVC Services Tuning? Windows 7/10

-

REVIEWS1 year ago

REVIEWS1 year agoBest Gaming Communities Like F95zone

-

OUTDOOR1 year ago

OUTDOOR1 year agoColoring Black and White Photo at Home

-

Technology1 year ago

Technology1 year ago5 Best React JS UI Frameworks for Swift Prototyping

-

REVIEWS1 year ago

REVIEWS1 year agoAll You Need to Know About KissAnime – Is it Safe and Legal?

-

Business1 year ago

Business1 year agoInside Versus Outside Sales