LIFESTYLE

3 Foolproof Ways To Pay Off Your Credit Card Debt

Depending on how you see it, credit cards can be a major convenience or a never-ending source of financial trouble. With the frankly extortionate rates charged by banks and credit card companies, one would do well to take care not to fall into credit card debt.

Here’s a quick test to determine if you’re overly reliant on your credit cards.

1. You pay for necessities such as food or gas with your credit card.

2. You regularly use up 40% or more of your card’s spending limit.

3. You get stressed out thinking about your bills.

4. You won’t be able to make ends meet without your credit card.

If you’ve answered yes to at least 2 or more of the above points, chances are that you’re in way above your head. Fret not, however, as you’re not alone. From a recent study, it was determined that nearly 70 percent of Americans will not be able to pay off their existing credit card debt within the year.

While it may be a cold source of comfort, there’s still hope yet. Having spoken to our team of experts and counselors, we take a look at how you can quickly and easily pay off your credit card debt.

1. Start Making Payments

Yes, you heard it right. The simplest yet most difficult way of getting out of credit card debt is by paying it off. Banks and credit card providers make most of their revenue by charging you exorbitant interest rates on any outstanding balance.

Thus, it’s always best to stay on top of your debt by continually making payments. Forget paying the minimum amount, pay as much as you can possibly afford every month. This strategy works best if all of your debt has been consolidated on a single card or if you’ve taken out a debt consolidation loan.

Paying the minimum amount only lengthens the time taken to pay off your debts while at the same time incurring additional interest.

If you have trouble budgeting your cash flow for the month, consider making payments twice a month. The first payment is made immediately after you’ve received your salary and the second towards the end of the month.

The first few months will be difficult at first, but as you adjust your lifestyle accordingly and start to see your debt falling, you’ll be motivated to continue onwards.

2. Consolidate All Of Your Debt

Facing down a mountain of debt can be overwhelming at first and at times, you won’t even know where to start. Don’t give up, instead start by taking stock of everything and anything that you may owe.

This gives you a “big picture” view of what needs to be paid off and when. From here, you can either opt to perform a balance transfer or take out a debt consolidation loan.

With a balance transfer, you’ll be able to transfer all outstanding debt to a new credit card that charges zero percent interest for a certain period of time. This gives you breathing room to pay off any outstanding debt.

On the other hand, a debt consolidation loan is a low-interest loan that is used to pay off your outstanding debts. These loans usually charge lower interest rates which in turn allow you to incur fewer interest expenses.

3. Perform A Self-Audit Of Your Expenses

A side-effect of today’s modern lifestyle means that most of us end up accumulating a variety of unneeded expenses. From Netflix and Hulu to nights out dining with friends, a lack of financial prudence is a surefire way for one to end up with crippling debt.

Instead of spending cash unnecessarily, seriously consider making a lifestyle change by performing a self-audit of your monthly expenses. Search for a more affordable internet package, cook more often and take public transport where possible.

The extra cash you’ll save up can then be used to pay off your debts. Experience has shown that over time, you’ll realize that you could actually have done without all the frivolous luxuries.

Now that you’ve finally paid off all your credit card debt, you should focus on staying out of it. Paying off your credit card debt may seem daunting but it’s in fact much easier than betting on the SuperBowl winners.

The hard part often comes from the many sacrifices and lifestyle changes that need to be made along the way.

LIFESTYLE

Top 4 Best Ski Goggles for Women for 2023/2024

When the mountain calls, the skier answers — not just with skill and fervor, but with gear that promises clarity in a world veiled by snowflakes. The choice of ski goggles for women (that is Skibrillen für Damen in German) is pivotal, a lens not only into the landscape but also into the sport’s very soul. The 2023 lineup of women’s ski goggles has been crafted not just to shield the eyes, but to enhance the vision of the skier, as they slice through the crisp alpine air.

Key Features to Look For

The modern woman skier knows that the right pair of goggles is as essential as the skis beneath her feet. When selecting her window to the winter world, several features stand paramount:

- Contoured Fit: Women’s goggles are contoured to the nuances of the feminine face, ensuring a snug fit without the pressure points that mar the joy of descent.

- Lens Technology: With lenses that adapt to the capricious moods of mountain weather, from the stark brightness of a sun-washed peak to the muted hues of an overcast trail, vision remains unimpeded.

- Anti-Fogging Brilliance: Advanced ventilation systems wage a silent war against the fog, keeping the view as pristine as the untouched snow.

Top Ski Goggles for Women in 2023 / 2024

- The Clarity Queen: Oakley Flight Deck XM

Oakley’s Flight Deck XM is a tribute to unobstructed views, boasting an expansive peripheral vision that serves as a vigilant sentinel against the unexpected. The PRIZM™ lens technology is a color-enhancing voyage, revealing the mountain in vivid detail, while the XM size caters to smaller facial structures without compromise.

- The magnetic one: Zerokay Magnet

This magnetic ski goggle is a limited production, certified to ISO 18527-1:2021 standards, ensuring safety and quality for both skiing and snowboarding. It comes with two interchangeable lens options: Orange Lens (S1 Protection): Designed for low visibility conditions and Silver Mirror Lens (S3 Protection), which is ideal for sunny days. Due to the magnetic lens technology you can switch effortlessly between between lenses.

- The Allure of the Anon WM1

Anon’s WM1 merges magnetism with clarity. The Magnetic Facemask Integration (MFI®) seals the bond between goggle and facemask, a bulwark against the elements. The spherical lens mimics the curvature of the human eye, not just for style but for an authentic panorama of the slopes.

- The Intersection of Style and Function

In the realm of ski goggles for women, style is not sacrificed at the altar of function. The 2023 selection is a celebration of this harmony, where aesthetic allure is not divorced from ergonomic design. Straps dazzle with patterns reflective of their wearer’s zest, and frames are sculpted to flatter, not to overshadow. To don these goggles is to make a statement, one that does not whisper but sings with the confidence of the skier who wears them.

User Experiences and Recommendations

The voices of the mountains — the women who thread through the pines and ascend the ridges — have spoken. They tell tales of the Flight Deck’s unrivaled field of view, of the I/O MAG S’s transformative vision across terrains, of the WM1’s magnetic charm that locks out the winter’s chill. These testimonials are not just reviews; they are chronicles of trust in technology that has been tried and tested in the theater of the alps.

Conclusion

As we stand on the threshold of another exhilarating ski season, the choice of goggles for the woman skier (German: Skibrillen für Damen) is pivotal. The best ski goggles for women in 2023 / 2024 are those that embrace the contours of femininity, champion the clarity of vision, and celebrate the individuality of style. Whether carving down a groomer or navigating a backcountry bowl, these goggles stand as vigilant guardians of the skier’s most valuable sense — sight.

The mountains await, and with the right pair of goggles, not a single detail of their majesty will be missed. Choose wisely, for through these lenses, you’ll not only view the mountain, you’ll witness its very soul.

LIFESTYLE

Double Chin Strap: A Solution to Define Your Jawline

Double Chin Strap many people, in a society so concerned with outward appearances, look for reliable methods to enhance their characteristics. People may feel uncomfortable with their profile if they have a double chin. However, twin chin straps have recently emerged as a viable option for dealing with this problem.

What is a Double Chin Strap?

You may minimize the look of your double chin with the use of a double chin strap, sometimes called a chin wrap or chin slimming band. Wearable beneath the chin and all the way around the head, these straps are often constructed of stretchy, skin-friendly fabrics. They help by holding the jaw in place and bolstering the neck.

How Do Double Chin Straps Work?

The idea behind the effectiveness of double chin straps is constant compression. The constant pressure they provide to your chin and neck aids with lymphatic drainage and blood flow. If you want a more defined jawline, this can assist with water retention and fat deposition around the chin.

Types of Double Chin Straps

1. Adjustable Double Chin Straps

All shapes and sizes of heads can use these straps. The straps or Velcro fasteners allow for a personalized and secure fit.

2. Chin Wraps

A chin wrap is a type of headband that is designed to cover and protect your chin. They often aren’t too bothersome to wear for long periods of time.

3. Chin Slimming Bands

Slimming bands for the chin are a subset of straps. To maximize their efficacy, most of them include extras like infrared treatment and vibration.

Benefits of Using a Double Chin Strap

- Non-Invasive:

The double chin can be concealed without surgery or discomfort with a chin strap.

- Easy to Use:

They are convenient enough to wear while going about one’s regular routine.

- Visible Results:

Consistent use, according to several customers, has led to a more defined jawline.

- Affordable:

Double chin straps are less expensive than surgical correction.

How to Choose the Right Double Chin Strap

There are a few things to keep in mind while shopping for a double chin strap:

Material

Check if the strap is made of a hypoallergenic, breathable material that won’t cause skin irritation.

Adjustability

If you want a snug yet comfortable fit, look for an adjustable strap.

Comfort

If you plan on using your backpack for long periods of time, look for straps with padding or cushions.

Durability

Make sure the strap will last by reading reviews and looking into the materials used.

How to Use a Double Chin Strap

- Place the strap under your chin.

- Secure it around your head, ensuring a snug fit.

- Wear it for the recommended duration (usually 30-60 minutes).

- Repeat regularly for best results.

Are Double Chin Straps Effective?

Double chin straps’ efficacy varies from user to user. While some people may see significant enhancements, others may not. To maximize their benefits, try using them alongside a good diet and exercise routine.

Potential Side Effects

Double chin straps are typically safe to wear, however they may cause minor pain or skin irritation in some people. If you want the best results with the fewest possible side effects, be sure to use the product exactly as directed by the manufacturer.

Alternatives to Double Chin Straps

Double chin straps may not be the best solution for certain people, but there are other options available, such as cosmetic surgeries, face workouts, and cosmetics.

Customer Reviews and Testimonials

Reading reviews and comments from other customers is a great way to learn more about the benefits of twin chin straps.

The Science Behind Double Chin Straps

A more defined jawline may be the consequence of regular massage of the chin and neck, which has been found to increase lymphatic drainage and decrease water retention.

Conclusion

A double chin may be minimized without surgery, can be purchased for a reasonable price, and can be easily accessed in the form of a chin strap. Although individual outcomes will vary, they might be a useful supplement to your existing beauty regimen. For the greatest results, it’s important to choose a comfortable strap and stick with it.

FAQ’s

How long should I wear a double chin strap each day?

The average daily recommendation is between 30 and 60 minutes.

Can double chin straps replace surgical procedures?

They may not be as life-altering as surgery, but they can nevertheless make a significant difference.

Are double chin straps comfortable to wear?

Most are made to be worn all day long without causing discomfort.

How soon can I expect to see results?

Some consumers have seen benefits in as little as two weeks, however this varies widely.

Are double chin straps suitable for all ages?

They are suitable for usage by adults of varying ages.

LIFESTYLE

Ultimate Guide on How to Organize Your Home on a Budget

Having an organized home can bring a sense of peace and calmness to your life, but it can also be an expensive and daunting task. However, organizing your home doesn’t have to break the bank, and with some planning, creativity, and elbow grease, you can achieve a clutter-free and functional home without spending a fortune.

In this ultimate guide to home living blog, we’ll provide you with tips and tricks on how to organize your home on a budget, including decluttering, storage solutions, and DIY projects. Let’s dive in!

Step 1: Decluttering

The first step in organizing your home on a budget is decluttering. Decluttering is the process of getting rid of items that you no longer need or use. It’s an essential step because it will help you free up space, reduce clutter, and make it easier to organize your belongings.

Here are some tips to help you declutter your home on a budget:

- Start with one room: Trying to declutter your entire home at once can be overwhelming. Start with one room and work your way through each room one at a time.

- Use the four-box method: When decluttering, use the four-box method. Label four boxes as “Keep,” “Donate,” “Sell,” and “Trash.” As you go through each item, decide which box it belongs in.

- Be honest with yourself: When decluttering, be honest with yourself about what you need and what you don’t need. Don’t hold onto items that you haven’t used in years or that have no sentimental value.

- Sell items: Consider selling items that are in good condition but no longer serve a purpose for you. There are many online marketplaces where you can sell items, such as eBay, Facebook Marketplace, and Craigslist.

- Donate items: Donate items that are still in good condition but that you no longer need. You can donate items to charity shops, local shelters, or online donation websites such as Freecycle.

- Recycle or dispose of items responsibly: For items that are broken or can’t be donated, recycle or dispose of them responsibly. Check with your local recycling centers or waste management services to see how to properly dispose of items such as electronics, hazardous waste, and large items.

Step 2: Storage Solutions

Once you’ve decluttered your home, it’s time to focus on storage solutions. Storage solutions will help you keep your home organized and tidy, and they don’t have to be expensive.

Here are some storage solutions to help you organize your home on a budget:

- Use baskets and containers: Baskets and containers are an affordable way to store items in your home. They can be used to store everything from toys and books to kitchen utensils and toiletries. Look for baskets and containers at discount stores or thrift stores.

- Repurpose items: Look for items that can be repurposed for storage. For example, a shoe organizer can be used to store cleaning supplies, or a muffin tin can be used to organize small items such as buttons or beads.

- Use shelves: Shelves are an affordable and practical way to store items in your home. You can install shelves on walls or use free-standing shelves. Look for inexpensive shelves at discount stores or online marketplaces.

- Use vertical space: When organizing your home, don’t forget to use vertical space. You can use hooks, pegboards, or hanging organizers to make use of vertical space and maximize storage.

- DIY storage solutions: DIY storage solutions can be an affordable and fun way to organize your home. For example, you can make your own shelves or storage boxes using inexpensive materials such as pallets or cardboard boxes.

Step 3: DIY Projects

DIY (Do-It-Yourself) projects are an excellent way to save money and personalize your home. They can also be a fun and rewarding activity for those who enjoy crafting and creating. Here are some DIY projects to help you organize your home on a budget:

- Pallet Shelves: Pallet shelves are an affordable and stylish way to add storage to your home. You can find pallets for free or cheap at most hardware stores or online marketplaces. Once you have the pallets, all you need is some sandpaper, paint or stain, and brackets to mount on the wall.

- Repurposed Mason Jars: Mason jars can be used for a variety of DIY projects, including storage. You can use them to store everything from office supplies to bathroom essentials. Simply clean the jars, add some labels or paint, and mount them on a board or a wall.

- DIY Storage Boxes: DIY storage boxes are an affordable and practical way to store items in your home. You can use cardboard boxes or even cereal boxes as a base and cover them with fabric or decorative paper. These boxes can be used for everything from storing books and magazines to organizing your pantry.

- Pegboard Organizer: A pegboard organizer is a versatile and affordable way to store tools and other items in your garage or workspace. All you need is a pegboard, hooks, and some paint or stain to create a custom storage solution.

- Magnetic Spice Rack: A magnetic spice rack is an affordable and space-saving way to organize your spices in the kitchen. All you need is some magnetic tape and small jars or containers to store your spices. Simply attach the magnetic tape to the back of the jars and mount them on a metal surface.

Conclusion

Organizing your home on a budget doesn’t have to be an overwhelming task. With some planning, creativity, and elbow grease, you can achieve a clutter-free and functional home without spending a fortune. Decluttering, storage solutions, and DIY projects are all excellent ways to organize your home on a budget. Remember, the key is to be creative, resourceful, and have fun!

-

Marketing1 year ago

Marketing1 year agoHow Often Should You Publish on a Blog?

-

Technology1 year ago

Technology1 year agoHow AI Can Transform Healthcare

-

Technology1 year ago

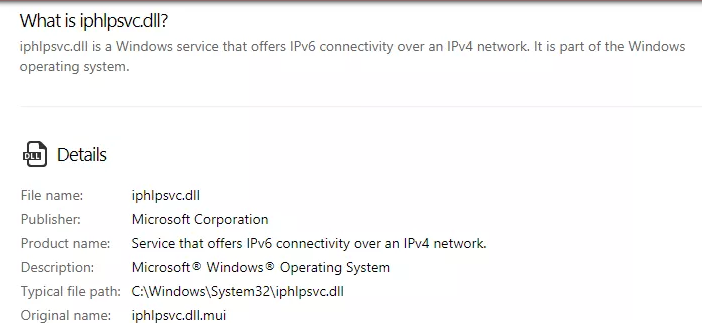

Technology1 year agoIPHLPSVC Services Tuning? Windows 7/10

-

REVIEWS1 year ago

REVIEWS1 year agoBest Gaming Communities Like F95zone

-

OUTDOOR1 year ago

OUTDOOR1 year agoColoring Black and White Photo at Home

-

Technology1 year ago

Technology1 year ago5 Best React JS UI Frameworks for Swift Prototyping

-

REVIEWS1 year ago

REVIEWS1 year agoAll You Need to Know About KissAnime – Is it Safe and Legal?

-

Business1 year ago

Business1 year agoInside Versus Outside Sales